Artificial Intelligence (AI) is revolutionizing financial services, driving significant changes in how banks and financial institutions operate. By making processes faster, smarter, and more secure, AI allows financial companies to meet growing customer demands efficiently. From enhancing customer service to detecting fraud, AI in financial services has become an essential tool in modern finance.

The Role of AI in Data Processing and Decision-Making

The financial services sector handles vast amounts of data daily. Manual analysis is time-consuming and prone to error. AI in financial services excels at processing large datasets rapidly and with high accuracy, enabling banks to make informed decisions faster. By identifying patterns and trends that humans might overlook, AI contributes to better risk management and investment strategies.

McKinsey’s report on AI’s potential in banking to explore how AI could add up to $1 trillion annually in value by 2030

Improving Customer Experience with AI

AI plays a crucial role in improving the customer experience. Banks and financial institutions leverage AI in financial services to provide personalized financial advice, automate routine tasks, and ensure compliance with complex regulatory standards. The rise of AI-powered tools such as chatbots and robo-advisors is reshaping how customers interact with their financial service providers, offering efficient, tailored, and always-available services.

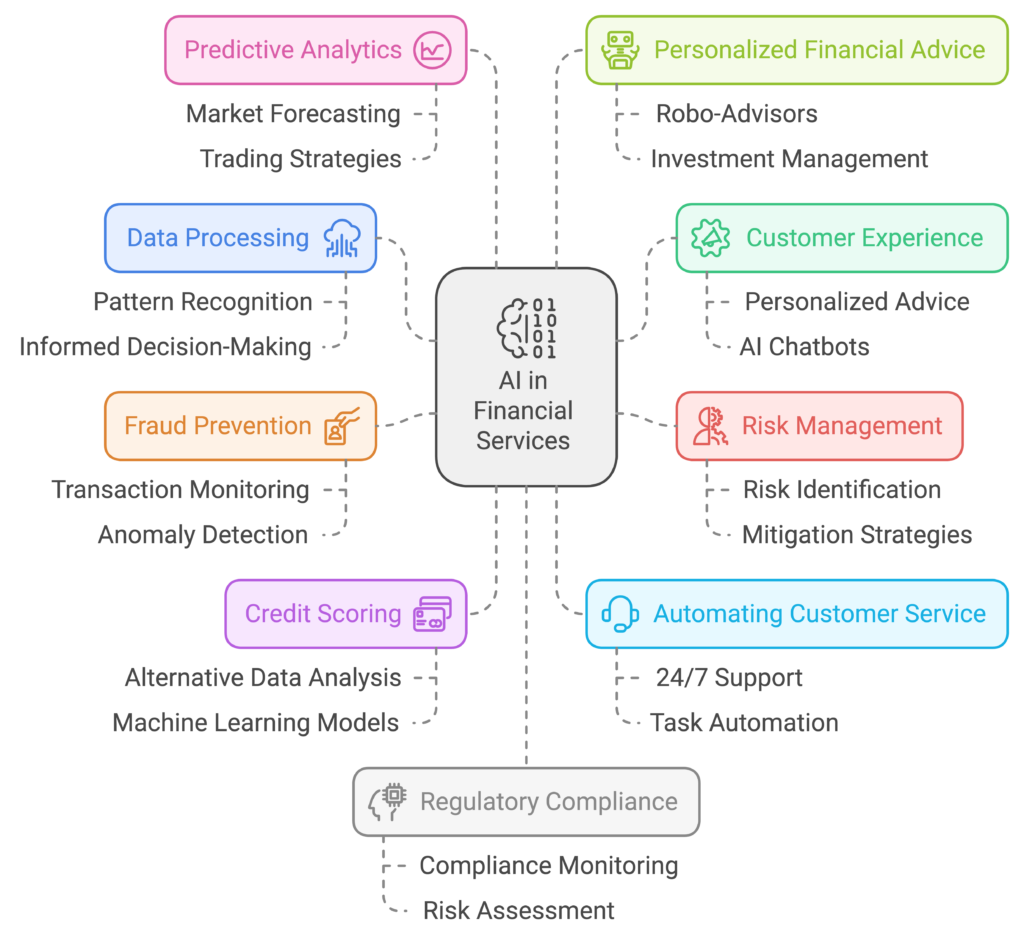

Key Applications of AI in Finance

AI continues to evolve, offering new opportunities for innovation in finance. Here are some of the key applications:

Risk Management and Fraud Prevention: AI analyzes large amounts of data to detect unusual activity, helping banks identify potential fraud and security risks early. This proactive approach enhances the safety of both customers and the institution.

Enhanced Customer Service: AI-powered chatbots are available 24/7, providing customers with immediate responses to their queries. This not only improves customer satisfaction but also reduces costs for financial institutions.

AI in Stock Trading: In the stock market, AI leverages data to predict price changes and execute trades quickly. This gives traders a competitive advantage by making more accurate, timely decisions that lead to higher profits.

Personalized Financial Advice: AI studies individual financial habits to provide customized advice. Tools like robo-advisors automate investment management, making financial planning more accessible.

Regulatory Compliance: AI simplifies compliance by automating processes, reducing errors, and ensuring that financial institutions adhere to evolving regulatory requirements.

AI in Financial Services: How AI is Solving Real Problems in the Industry

Artificial Intelligence (AI) is not just a futuristic concept in the finance industry; it’s actively being used today to solve real-world problems. From automating manual processes to detecting fraud and enhancing customer experience, AI is revolutionizing the way financial institutions operate.

Real-World Use Cases of AI Services in Finance

1. Fraud Detection and Prevention

Problem: Financial institutions face an ever-growing threat from fraud, including credit card fraud, identity theft, and insider trading. Traditional methods of fraud detection rely on manually processing thousands of transactions, making it difficult to identify fraud in real-time.

AI Solution:

- Example: JP Morgan Chase uses AI to detect fraudulent transactions faster and more accurately than human analysts. AI models trained on vast datasets can analyze transaction patterns in real time, flagging suspicious activities such as unusual spending behavior, large withdrawals, or unauthorized access from different locations.

- AI systems can prevent fraud by using machine learning to learn from past fraudulent behaviors and detect anomalies that deviate from normal patterns. These systems send immediate alerts to customers or block the transaction before it can be processed.

Results: AI reduces the response time for fraud detection and prevents millions in losses by identifying fraudulent activities before significant damage can occur. For instance, JP Morgan’s AI tools have been crucial in reducing false positives, allowing legitimate transactions to proceed while blocking fraudulent ones.

2. Credit Scoring and Loan Underwriting

Problem: Traditional credit scoring models like FICO are often limited by outdated data or a narrow set of criteria. This leaves many individuals and small businesses without access to credit, even if they are low-risk borrowers.

AI Solution:

- Example: Zest AI and Upstart are fintech companies that use AI to assess creditworthiness. Instead of relying solely on credit history, AI models can analyze alternative data sources such as employment history, social media activity, spending behavior, and even mobile phone usage.

- AI can evaluate a much broader set of data, enabling lenders to offer loans to people who were previously deemed uncreditworthy by traditional models. Machine learning algorithms continuously improve the accuracy of their predictions over time.

Results: AI has helped financial institutions significantly reduce default rates while increasing loan approval rates, particularly for underserved populations. For example, Upstart claims that their AI models can reduce the default rate by 75% while increasing approvals by 27%, opening up credit to millions of new borrowers.

3. Automating Customer Service

Problem: Financial institutions often face high volumes of customer inquiries that can overwhelm support teams, leading to long wait times and customer dissatisfaction.

AI Solution:

- Example: Bank of America’s AI-powered virtual assistant Erica helps customers manage tasks like checking account balances, making payments, and providing financial insights. Erica uses natural language processing (NLP) to understand customer queries and provide relevant answers, much like a human support agent would.

- AI chatbots can operate 24/7, offering instant support and handling routine tasks such as answering questions, updating account details, or processing payments.

Results: Erica has serviced over 6.3 million customers, addressing over 50 million inquiries since its launch. AI-driven chatbots and virtual assistants dramatically reduce the workload on human customer service teams, allowing them to focus on more complex inquiries. This results in faster response times, improved customer satisfaction, and reduced operational costs.

4. Predictive Analytics in Trading

Problem: Traditional trading relies on human judgment and historical data analysis, which often leaves room for emotional decision-making and missed opportunities. In fast-paced environments like the stock market, split-second decisions can lead to significant gains or losses.

AI Solution:

- Example: BlackRock’s AI-powered platform Aladdin uses machine learning and predictive analytics to assess market trends, forecast price changes, and identify optimal trading strategies. AI models can process vast amounts of market data, including historical prices, news events, and even social media trends, to predict price movements and execute trades automatically.

- AI-driven trading algorithms analyze real-time data at speeds far beyond human capacity, enabling financial institutions to make data-driven decisions without human biases.

Results: AI in trading reduces the risk of emotional or impulsive decisions, leading to more consistent profitability. BlackRock’s Aladdin system manages over $21 trillion in assets, helping portfolio managers optimize their trades by identifying patterns that human analysts might miss.

5. Personalized Financial Advice and Wealth Management

Problem: Many consumers lack access to tailored financial advice, particularly those who do not meet the high minimum balance requirements of traditional wealth management firms.

AI Solution:

- Example: Betterment and Wealthfront are leading robo-advisors that use AI to offer personalized investment strategies based on individual financial goals, risk tolerance, and market conditions. These platforms automatically adjust portfolios based on real-time market data and changes in user preferences.

- AI systems can recommend a diversified portfolio, rebalance investments, and even minimize tax liabilities without requiring human intervention.

Results: AI democratizes access to financial planning by offering high-quality advice to individuals who previously couldn’t afford it. These robo-advisors manage billions in assets and have been instrumental in bringing financial management to a broader audience. Betterment, for instance, manages over $30 billion in assets and continues to grow as more users adopt its AI-driven services.

6. Regulatory Compliance (RegTech)

Problem: Financial institutions must comply with complex and evolving regulations such as AML (Anti-Money Laundering), KYC (Know Your Customer), and GDPR. Ensuring compliance manually is time-consuming, costly, and prone to error.

AI Solution:

- Example: Ayasdi, a RegTech firm, uses AI to help banks identify compliance risks and ensure they meet regulatory requirements. AI can automatically scan through large datasets of transactions, customer information, and communications to identify compliance violations or suspicious activity.

- By using machine learning, these systems can continuously improve in detecting potential risks and automate reporting to regulatory bodies.

Results: AI reduces the time and cost associated with regulatory compliance. Financial institutions using AI for compliance have reported up to a 90% reduction in false positives and faster resolution of flagged issues. In 2017, HSBC used AI to monitor financial transactions and compliance across their global operations, significantly reducing the risk of regulatory fines.

Artificial Intelligence is reshaping the finance industry by addressing core challenges such as fraud, inefficiency, and limited access to financial services. By offering real-time fraud detection, personalized financial advice, and enhanced customer service, AI is transforming finance into a more secure, accessible, and efficient sector.

As AI continues to advance, its applications in risk management, trading, compliance, and wealth management will only expand, driving further innovation and helping financial institutions solve increasingly complex problems.

If you need any consultation or expert guidance on how AI in financial services can benefit your organization, feel free to connect with us. Our team is here to help you leverage the latest AI technologies to solve your most pressing financial challenges.